Al Bai Bithaman Ajil

Almsgiving atau tithing ialah derma yang wajib diberikan orang Islam yang mampu kepada 8 golongan asnaf yang berhak menerimanyaUmumnya wujud dua pendapat ada menyatakan rukun Islam ketiga ialah puasa Ramadan dan ada yang menyatakan rukun ketiga Islam ialah zakat. There are five main contracts in Islamic finance.

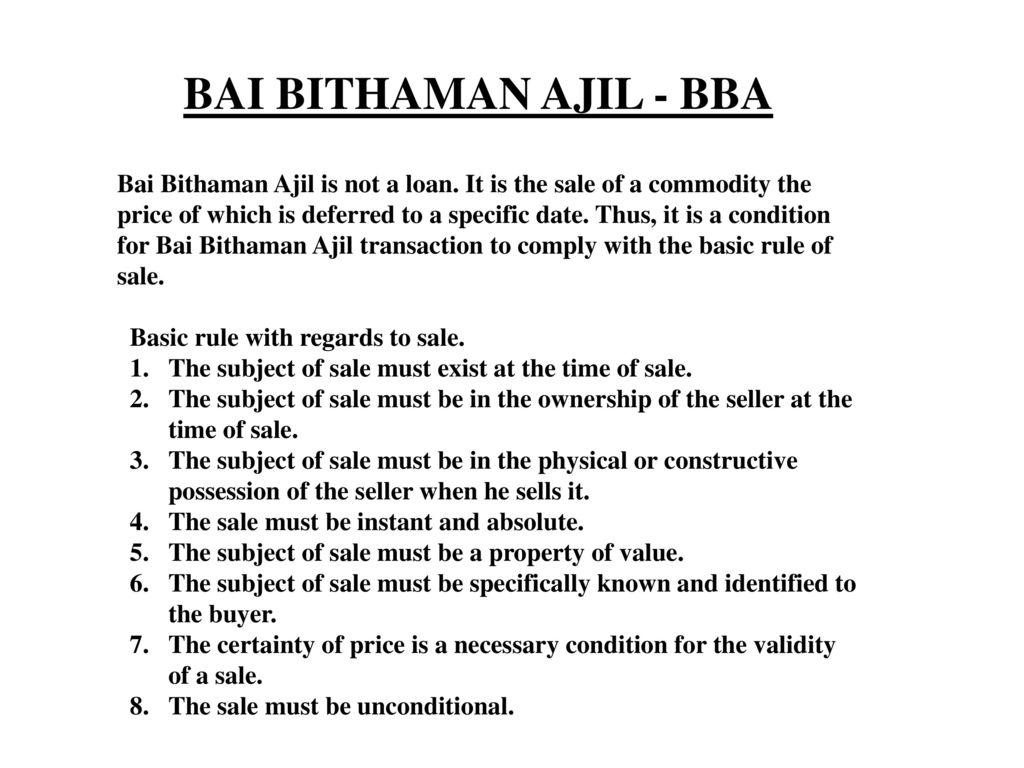

The issue in deliberation was whether the asset pricing requirements would also be applicable for sukuk structured based on any Shariah principles without limiting to sukuk structured based on uqud muawadhat such as bai bithaman ajil murabahah istisna and ijarah or wakalah bi al-istithmar which involves the components of sale and purchase of assets or commodities.

. THE ISSUE AND DELIMMA OF THE BAI BITHAMAN AJIL CONTRACT AS MODE OF ISLAMIC FINANCE. Partha Sarathi has 11 jobs listed on their profile. Al-Hiwalah pemindahan hutang Mudarabah Perkongsian Wadiah Janji Menyimpan Bentuk-Bentuk Kontrak al-AqdPertukaran Dalam Is.

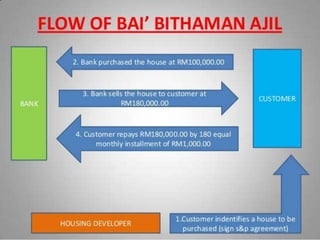

Maka pada tahun 2001 Bank Islam meluluskan penstrukturan hutang-hutang itu melalui kemudahan pembiayaan Islam al-Bai Bithaman Ajil BBA kepada YAB Tan Sri Khalid. Al-Qardhul Al-Hasan Pinjaman Tanpa Faedah Hibah Pemberian Wakalah Wakil Ar-Rahnu Gadaian Kafalah Jaminan BAB 2. Menurut istilah syarak pula ialah Ijab dan Qabul aqad yang menghalalkan persetubuhan antara lelaki dan perempuan yang diucapkan oleh kata-kata yang menunjukkan nikah menurut peraturan yang ditentukan oleh IslamPerkataan zawaj digunakan di dalam al-Quran bermaksud pasangan dalam.

Zakat زكاة dari kata tazakka - mensucikan bahasa Inggeris. View Partha Sarathi Das MBA FRM PMP CBAP CSMs profile on LinkedIn the worlds largest professional community. Bay bithaman ajil Also called Bai muajjal 49 abbreviated BBA and known as credit sale or deferred payment sale.

Perkahwinan atau nikah menurut bahasa ialah berkumpul dan bercampur. AL HIWALAH DI DALAM SISTEM PERBANKAN. Terma kemudahan pembiayaan ini dimuktamadkan di dalam Surat Tawaran bertarikh 17 April 2001 Perjanjian Induk Kemudahan BBA bertarikh 30 April 2001 dan perjanjian-perjanjian.

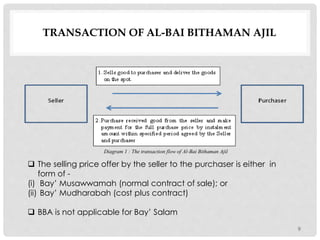

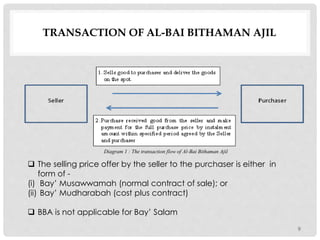

Reportedly the most popular mode of Islamic financing is cost-plus murabaha in a credit sale setting Bay bithaman ajil with an added binding promise on the customer to purchase the property thus replicating secured lending in Sharia compliant. AL-BAI BITHAMAN AJIL THE SHARIAH AND LEGAL ISSUES ON ITS APPLICATION AS A FINANCING FACILITY. Finacle Islamic Banking Solution for.

Mostly they are based on sale and purchase transactions accompanied by a degree of risk. For Islamic banks to a make profit and to satisfy the borrowers needs of cash they have to conduct transactions that do not violate Islamic rules by looking for allowed contracts that can achieve the required goal. See the complete profile on LinkedIn and discover Partha Sarathis.

Al Bai Bithaman Ajil Syariah And Legal Issues The Malaysian Exper

Compare And Contrast Aitab And Al Bai Bithaman Ajil Ppt Download

The Structure Of Bai Bithaman Ajil Bba House Financing Download Scientific Diagram

Comments

Post a Comment